This week, GE Vernova shared two important updates, both of which we will discuss on today’s call.

Yesterday, we announced that we will acquire the remaining fifty percent stake of Prolec GE, our joint venture with Xignux, for $5.275 billion. The transaction strengthens our company’s position as a global grid equipment leader through a highly attractive, accretive acquisition of a leading grid equipment supplier and is expected to close by mid-2026, subject to regulatory approvals.

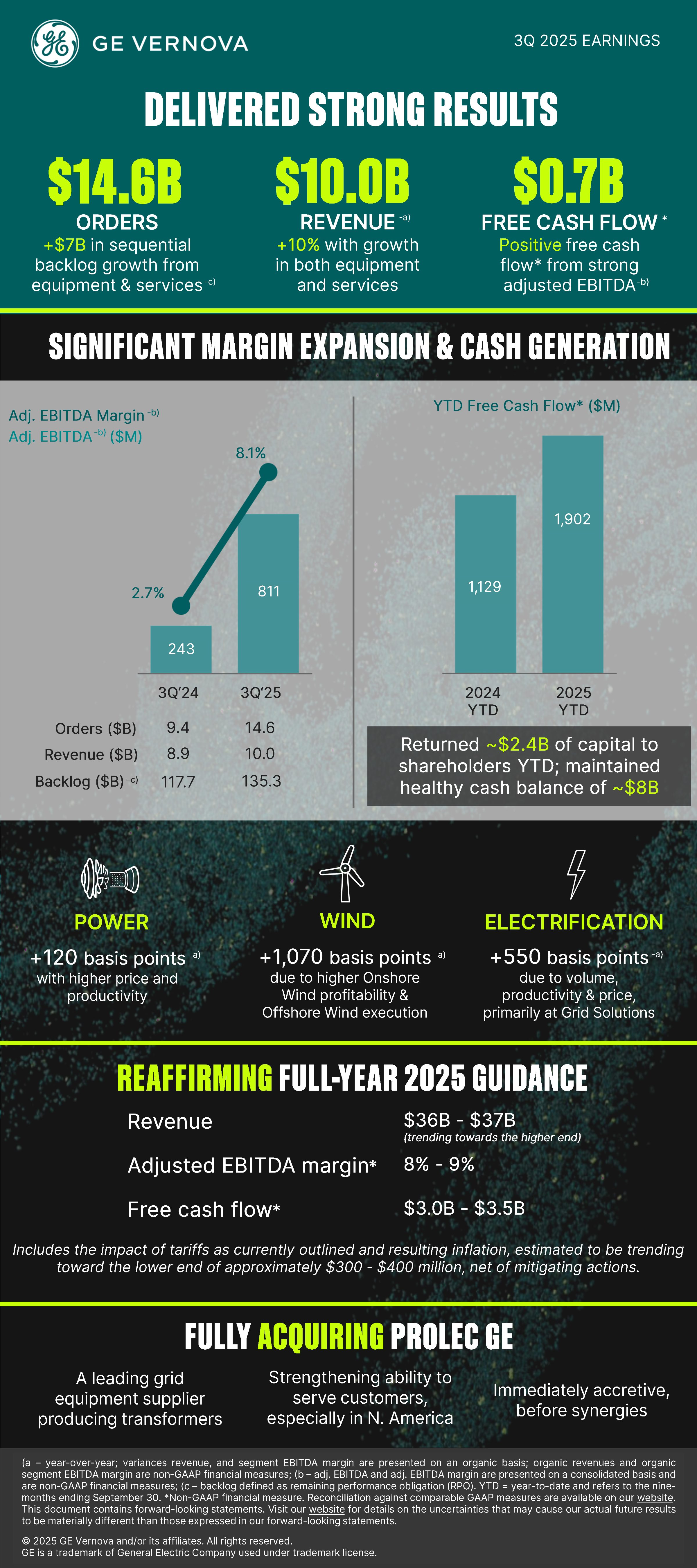

Today, we released our third quarter 2025 financial results. We had a strong quarter, with robust orders and backlog growth, continued margin expansion, and positive free cash flow. We reaffirmed our 2025 financial guidance.

We encourage you to review the earnings materials and listen to our webcast beginning at 7:30 AM ET. A replay of the webcast will be available on our website at https://www.gevernova.com/investors.

Third quarter 2025 highlights:

- Orders of $14.6B, +55% organically, led by equipment at Power and Electrification

- Backlog[1] growth of $6.6B sequentially from equipment and services

- Gas Power equipment backlog and slot reservation agreements grew from 55 to 62 GW

- Revenue of $10.0B, +12%, +10% organically*, with growth in both equipment and services

- Net income of $0.5B; net income margin of 4.5%

- Adjusted EBITDA* of $0.8B and adjusted EBITDA margin* of 8.1%

- Cash from operating activities of $1.0B; free cash flow* of $0.7B

- $7.9B cash balance; $2.4B in capital returned to shareholders year-to-date

GE Vernova CEO Scott Strazik said, “GE Vernova delivered another productive quarter with strong financial results. Our growth trajectory is accelerating and the demand environment for our equipment and services remains strong with $16 billion in backlog growth year-to-date. Our Gas Power equipment backlog and slot reservation agreements increased from 55 to 62 gigawatts sequentially, and our Electrification equipment backlog increased $6.5 billion year-to-date, to approximately $26 billion. We are leading from a position of strength and are focused on long-term growth and returns. This era of increased electricity investment has just started, and we have substantial opportunity ahead of us as we provide the solutions required to help the world electrify to thrive and decarbonize.”

GE Vernova CFO Ken Parks said, “We delivered another strong quarter as we executed our financial strategy, with continued orders and revenue growth, significant margin expansion, and positive free cash flow. We expanded our backlog year-over-year and sequentially across equipment and services, with healthy equipment margin in backlog reflecting favorable price and our focus on disciplined underwriting. As a result of our improving free cash flow linearity, we continued to return cash to shareholders through our share repurchase actions and quarterly dividend payment, while maintaining a healthy cash balance and solid investment grade balance sheet. We’re reaffirming our 2025 financial guidance, and we look forward to providing our 2026 financial guidance and updated outlook by 2028 at our investor event on December 9.”

Reaffirmed GE Vernova 2025 financial guidance:

GE Vernova expects revenue to trend towards the higher end of $36-$37 billion, adjusted EBITDA margin* of 8%-9%, and free cash flow* of $3.0-$3.5 billion. The guidance includes the impact of tariffs as currently outlined and resulting inflation, which is estimated to be trending toward the lower end of approximately $300-$400 million, net of mitigating actions.

We are encouraged by our strong year-to-date performance and look forward to sharing more in December. To stay in touch with future GE Vernova releases, please visit our website and sign up for email alerts. We thank you for your interest in GE Vernova and look forward to connecting with you in the fourth quarter.

Best,

Michael & team

1Defined as remaining performance obligation (RPO)

*Non-GAAP Financial Measure. The reasons we use these non-GAAP financial measures and the reconciliations to their most directly comparable GAAP financial measures are included in our third quarter 2025 earnings release and presentation slides posted on our Investor Relations website at https://www.gevernova.com/investors.

This document contains forward-looking statements. Forward-looking statements provide current expectations of future events based on certain assumptions. Words such as “expects,” “intends,” “plans,” and similar expressions, may identify such forward-looking statements. Except as required by law, we disclaim any obligation to update any forward-looking statements.

[1] Defined as remaining performance obligation (RPO)

*Non-GAAP Financial Measure